Introduction

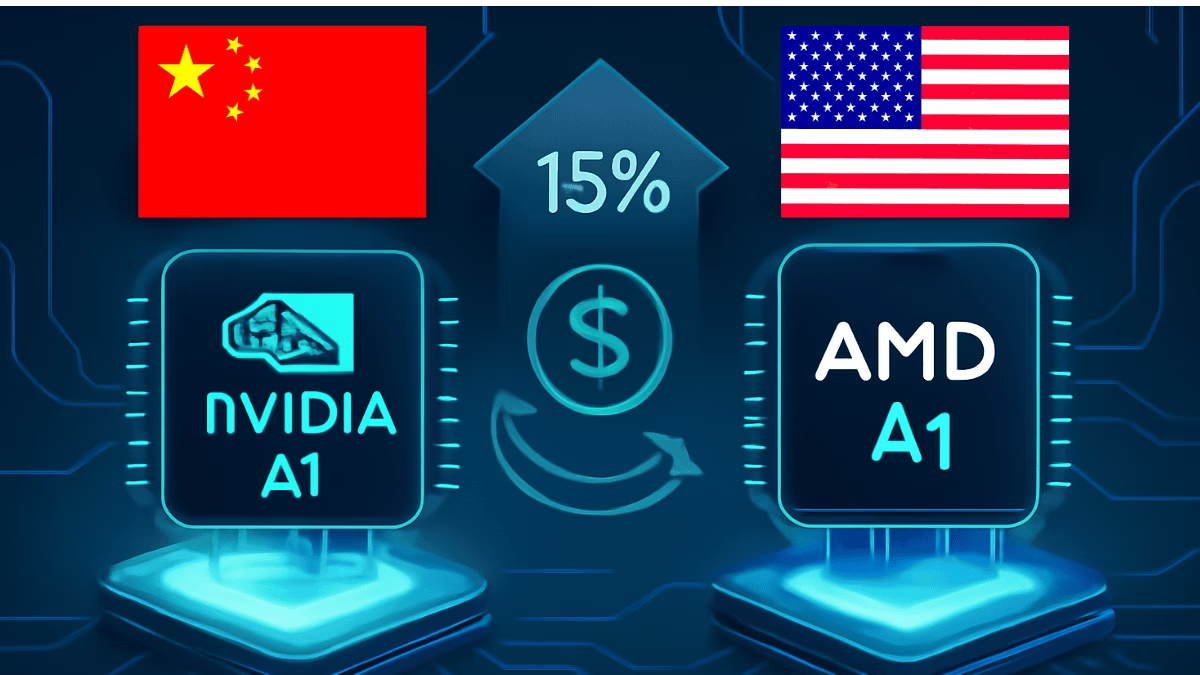

In one of the most surprising technology trade developments of 2025, Nvidia and AMD have agreed to pay 15% of their China AI chip sales revenue directly to the U.S. government. This agreement is not just about money — it reshapes the balance between national security, corporate profits, and global trade.

The deal, which allows both companies to resume sales of their most advanced AI processors such as the Nvidia H20 and AMD MI308, comes after months of tense negotiations and is tied to special U.S. export licenses.

The Background of the Deal

The U.S. government had previously banned the export of advanced AI chips to China out of concern that they could be used in military technologies, surveillance systems, and state-level AI programs. These export controls were aimed at limiting China’s access to the cutting edge of AI hardware.

However, with China representing a multi-billion-dollar market for American chipmakers, the pressure to find a compromise was immense. After a series of high-level talks — including a pivotal meeting between Nvidia CEO Jensen Huang and President Trump — the U.S. Commerce Department agreed to issue partial export licenses. The condition was unusual: both Nvidia and AMD must share 15% of their China AI chip revenue with Washington.

Why a 15% Revenue Share?

Balancing Security and Trade

The 15% arrangement works like a strategic export tariff. It ensures:

- The U.S. benefits financially from sales to a strategic competitor.

- American technology continues to hold a presence in China’s AI sector.

- The U.S. government retains oversight of what is being exported.

Instead of banning sales outright, this approach tries to preserve both national security interestsand corporate competitiveness in the $600+ billion semiconductor market.

Criticism from Both Sides

- National security advocates argue that if chips are risky, they shouldn’t be sold to China in any form, regardless of revenue sharing.

- Market analysts counter that this approach is a pragmatic middle ground that prevents China from fully turning to non-U.S. suppliers while still generating revenue for the American government.

Financial Impact on Nvidia & AMD

ALSO READ : AMD Earnings: Riding the AI Wave

For Nvidia, China brought in roughly $17 billion in 2024 — about 13% of its global revenue. AMD’sChina sales were around $6.2 billion, close to a quarter of its total revenue.

Even after a 15% cut, the sales potential in China is too significant for either company to walk away from. Investors seemed to agree — Nvidia’s stock hit a record high following the news, while AMD shares approached their 52-week peak.

The deal also signals to Wall Street that the companies have found a path forward in one of their most important overseas markets.

Broader Geopolitical Implications

A New Template for Tech Exports

The Nvidia–AMD model of revenue sharing could become a blueprint for future U.S. export policy, not only for semiconductors but also for industries like defense technology, aerospace, biotech, and quantum computing.

China’s Strategic Position

From Beijing’s perspective, this ensures continued — though limited — access to advanced U.S. AI hardware, giving China time to further develop domestic semiconductor capabilities. It also reduces the chances of cutting-edge AI innovation in China being entirely dependent on non-U.S. sources.

The Road Ahead

As AI technology becomes an increasingly critical part of national power, we can expect similar controlled-market access agreements in other high-tech sectors. The U.S.–China tech rivalry is far from over — and this deal is just one more step in a much larger game.

There is also a possibility that other governments adopt similar “profit-for-permission” models, especially in sensitive sectors where innovation and national interest collide.

Conclusion

The Nvidia & AMD 15% China chip sales deal is far more than a commercial arrangement — it’s a symbol of the evolving relationship between technology, national security, and global trade policy.

By allowing these companies to tap into China’s huge market while ensuring a direct U.S. financial benefit, this policy shows how governments may adapt to compete in a world where economic strength and technological leadership are inseparable.

This agreement could ultimately become the new normal for high-stakes technology exports — one that investors, policymakers, and global industry leaders will closely watch in the years ahead.

Disclaimer:

The information presented in this blog is for informational and educational purposes only and does not constitute financial, investment, legal, or professional advice. While every effort has been made to ensure the accuracy and reliability of the content, market conditions and regulatory environments are subject to change. Readers should perform their own due diligence and consult with a qualified professional before making any business or investment decisions. The author and publisher are not responsible for any losses or damages arising from the use of this information.

1 thought on “Nvidia & AMD to Pay 15% of China Chip Sales to U.S. — Why It Matters”

Comments are closed.